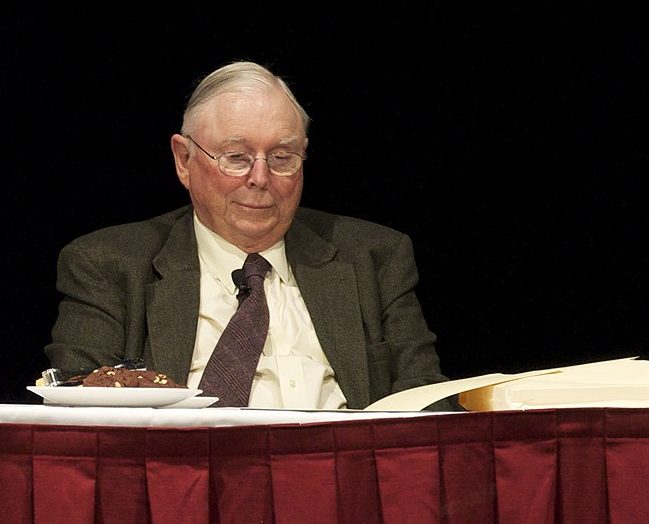

If you’re struggling to build wealth and it all feels impossible, you’re far from alone—especially in today’s economic climate. But one of the most respected financial minds of our time, the late billionaire Charlie Munger, had a refreshingly blunt take on where true financial freedom begins. And no, it’s not with millions, crypto bets, or chasing the next startup unicorn.

Instead, Munger insisted on one deceptively simple and brutally honest goal:

Get to $100,000. No matter what.

“I don’t care what you have to do,” Munger once said in the late 1990s. “If it means walking everywhere and not eating anything that wasn’t bought with a coupon—do it. Just get your hands on $100,000.”

He didn’t sugarcoat it either.

“The first $100,000 is a b*tch,” he famously admitted. “But you gotta do it.”

Why the First $100,000 Is So Important

Munger wasn’t just tossing out a number. That first $100K, he argued, isn’t just a financial goal—it’s a mindset shift, a test of discipline, and the launchpad for everything that follows. Once your money hits that threshold and is invested wisely, it starts working for you. That’s where compound interest—the real wealth builder—takes over.

In practical terms, if someone invests $10,000 a year at an average annual return of 7% (roughly the historical average of the stock market), it might take close to eight years to reach $100,000. But after that, the process speeds up.

From there:

-

$100,000 compounding at 7% becomes $200,000 in just over 10 years.

-

Stay invested for 40 years and it snowballs into more than $1.4 million.

That’s the power Munger was talking about. Not magic. Just math—and the discipline to trust it.

Why It’s So Hard—And Why That Matters

The first six figures are often the toughest for psychological reasons as much as financial ones. It’s during this stretch that habits are forged, temptations tested, and sacrifices demanded. Whether it’s cutting back on lifestyle choices, picking up side income, or simply staying consistent with your savings plan—this stage is where most people give up.

But those who push through unlock a massive advantage: the ability to earn more from their money than from their labor. That’s the true definition of financial leverage—and it begins at $100,000.

Adjusted for Today: Still Brutal, Still Necessary

Back in the ’90s, $100,000 went a lot further. Adjusted for inflation, that same milestone would now be closer to $190,000. But the lesson still holds. Getting to that first major benchmark is like a financial bootcamp. You build resilience, you develop systems, and most importantly—you prove you can do hard things consistently.

Whether it takes five years, ten, or more, the real value isn’t just in the money—it’s in the transformation that gets you there.

How Real People Are Doing It Today

Many who reach that milestone follow similar patterns:

-

High savings rates: Living below their means and putting away 30–50% of income.

-

Smart side hustles: Freelance work, online businesses, or gig economy jobs that build extra capital.

-

Low-fee investing: Putting money into index funds that mirror the S&P 500, averaging ~7% returns over time.

-

Simple strategies: Some even opt for interest-bearing accounts like CDs, which can offer 4–5% returns—though they lack the explosive compounding of equities.

Munger himself emphasized focus over diversification. He once said the Munger family only held a few stocks—a bold but calculated strategy. His approach wasn’t about outsmarting the market; it was about sticking with what you understand and staying the course.

The Final Word: Do the Hard Thing—Then Watch It Get Easier

Wealth doesn’t begin with shortcuts or sudden windfalls—it begins with grit, focus, and patience. Charlie Munger knew this better than anyone. Alongside Warren Buffett, he helped build one of the most successful investing empires in history—not by chasing hype, but by honoring consistency.

So if you’re still clawing toward that first $100,000, don’t be discouraged. You’re doing the hardest part. And once you hit that mark and let time take over, the math starts working in your favor.

As Munger said plainly:

“It’s brutal. But you gotta do it.”

Source:

Charlie Munger archives, long-term stock market performance data, historical inflation trends.